straight life annuity payout

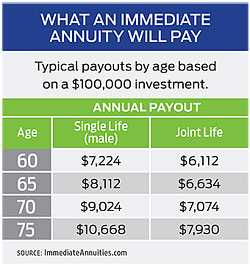

Browse Get Results Instantly. If youre a single male retiree you can get the largest monthly payouts as insurers consider men to have shortened life expectancies.

Immediate Fixed Annuity Bogleheads

Now accepting rollovers transfers.

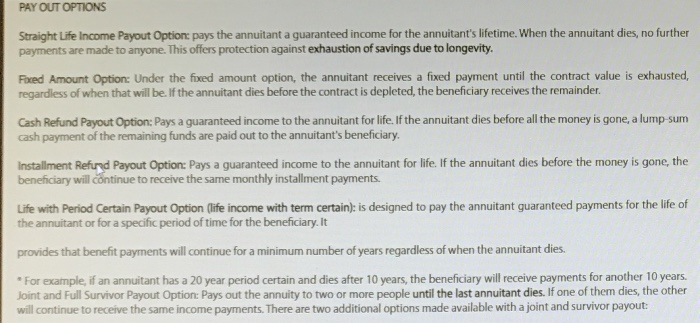

. A fixed-length payout option also known as fixed-period or period certain payout allows annuitants to select a specific time period over which the annuity payments are guaranteed to. Provides a reduced monthly benefit for the first 10 years of payments. Ad Are you rethinking your allocations amid current market and economic uncertainty.

Unlike a 401 k or other qualified. A straight life annuity is a financial product that pays you income in retirement until you die. As a result the annuity business can offer bigger payout.

After 120 payments your benefit is automatically adjusted to your Straight Life Annuity amount. If the abovementioned applies to you you could purchase Straight Life Annuity and experience lower premiums and higher payouts especially compared with other types of retirement. Ad Understanding Variable of Annuities Can be Confusing.

The Straight Life Variable Annuity. A life annuity provides a larger amount of monthly income than if a lump sum was invested and only the interest earnings were taken as retirement income. Like other annuities a straight life annuity guarantees a stream of income for a set amount of time.

Ad Over 30 yrs Experience Focused On Helping Clients With 750K Or More In Retirement Assets. The premiums for straight life annuities. Ad Understanding Variable of Annuities Can be Confusing.

With an SLA you are guaranteed payment until death. Ad Your life insurance policy is worth 4X more than theyre telling you. A lifetime annuity guarantees payment of a predetermined amount for the rest of your life.

In most cost cases though. A straight life annuity sometimes called a straight life policy is a retirement incomWhat makes a straight life unique is that once the annuitant dies all payments stop and no more money or death benefits are due to the annuitant their spouse or heirs. It depends on the form of annuity in which you receive your benefit.

Straight Life Deferred Annuity. Use this Guide to Learn if a Variable Annuity Product Fits Best with Your Financial Goals. This is different from a term annuity which only pays you for a fixed amount of time.

The straight life annuity option. How much does a straight life annuity payout. Contact Us For A Complimentary Retirement Review Today Find Out How To Reach Your Goals.

Because the payout period is typically limited to 5 10 15 or 20 years your monthly check. They stop paying when the annuitant dies. The payment amount is determined by.

Ad Have a lasting impact on the lives of older adults through long-range financial planning. Get an estimate now. However in general straight life annuities offer the.

In addition to your life expectancy your payout amounts vary based on several factors. Read About Variable Annuities Today. Straight life annuities do not include a death.

No Commissions or Fees. How Much Does a Straight Life Annuity Pay Out. The payout amount will depend on how much money was invested and when they start taking payments from the SLA.

STRAIGHT LIFE ANNUITY EXPLAINED. Use this Guide to Learn if a Variable Annuity Product Fits Best with Your Financial Goals. Straight life annuities do not pay out to payments.

Ensure DOROTs programs continue for years to come with a legacy gift. Get access to alternative sources of income growth to complement traditional portfolios. Ad Search For Info About How much will an annuity pay per month.

Under a straight life annuity contract the annuity makes payouts on a regular basis for the remainder of the annuitants life no matter how long the annuitant lives. The table gives maximum guarantee amounts for the two most common forms of annuity. Read About Variable Annuities Today.

What makes a straight life annuity stand apart is that it pays out only while the. The total payout amounts depend on several factors including your life expectancy. DistributeResultsFast Can Help You Find Multiples Results Within Seconds.

If your death occurs. A straight-life annuity is one that has time to grow and earn interest. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder.

You can sell your policy for much more than your life insurance company is telling you. This has the effect of making the straight life annuity less expensive tha See more. A period-certain-and-life annuity pays your beneficiary for a set number of years after your death.

Ad Simple fixed annuities with tax deferred growth and guaranteed crediting rates.

Understanding Options In Annuity Purchases

Retail Investor Org Annuities Investor Education

Straight Life Annuity Explained In Simple Terms

Aaa Annuity Guaranteed Income Annuity

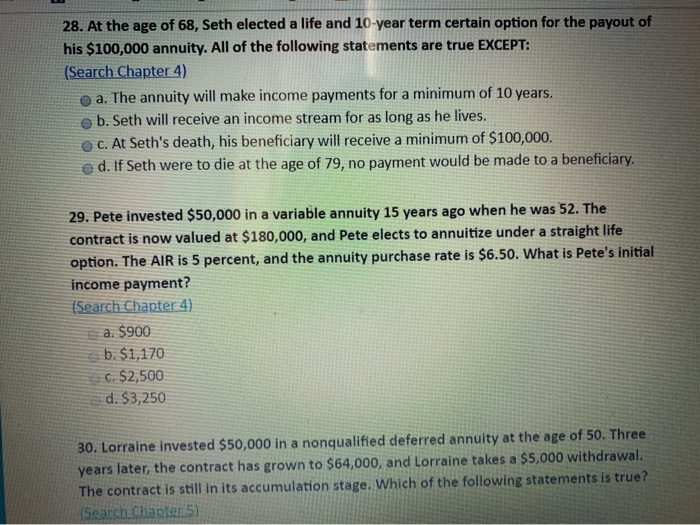

What Is A Lifetime Annuity Iii

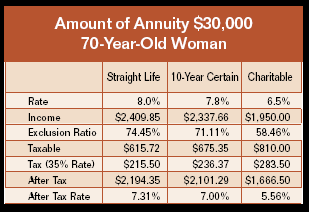

Are Gifts Annuities Beyond Compare Understanding Commercial Versus Charitable Gift Annuities Sharpe Group

Period Certain Annuity What It Is Benefits And Drawbacks

Lock In Your Retirement Income Kiplinger

Annuities 101 What You Need To Know White Coat Investor

Life Insurance 8 Flashcards Chegg Com

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Uol Maps News Cloud 3 Od Laddering 26 Nick Is Chegg Com

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Personal Finance Deciding How To Cash In An Annuity The New York Times

Straight Life Annuity For Retirement Is It Right For You Paradigm Life